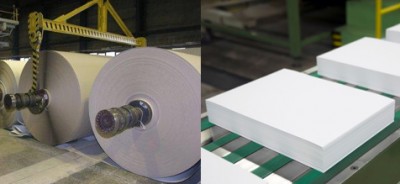

Pulp producers come out with price hikes for BEK & other pulp grades w.e.f January 01, 2017

(02 Dec 2016) The hardwood pulp (eucalyptus kraft) segment continues to report strong prices. Pulp producers like Ence, Cenibra, Fibria, etc. have announced a new round of hikes effective January 01, 2017.

Spain’s pulp firm ENCE has announced a BEK [bleached eucalyptus kraft pulp] $10/t price hike lift BEK prices to $675/t, EUWID reports.

The new price hike comes on the heels of a $10/t mark-up implemented in October and targets a new list price of $675/metr.t, EUWID said quoting company sources.

Brazilian pulp firms Cenibra and Fibria will also be hiking BEK prices w.e.f January 01, 2017 by $20/tonne in North America and Europe.

NZ-based Winstone Pulp International (WPI) has announced a $20/tonne BCTMP hike across Asia, effective immediately.

Analyst Report

Commenting on the recent hardwood (HW) pulp prices hikes, a BTG Pactual report dated Nov. 23, 2016 said that “while the recent price hikes appear to be sticking for HW, the data suggests that the hikes are probably largely motivated by delays in the start-up of APP’s Oki plant (although we do recognize Chinese demand remains firm). The reality is that delays in the start-up of Oki appear to have delivered a short window of opportunity for price increases (two rounds of hikes already announced by major players). However, we maintain a more tempered enthusiasm, believing this is a more short-term move.”

Under construction in Ogan Komering Ilir (OKI) in South Sumatra, APP’s massive new HW pulp mill has a design capacity of 2.8 million ton/yr (image courtesy Tappi)

PPPC [Pulp & Paper Products Council] stats for HW for the month of October bear this out. October statistics for HW were unimpressive yet again in October with the market seemingly looser than what the recent price hikes suggest (operating rates for HW came in at 77% / shipments down 3% y/y).

Total shipments were relatively flat y/y, with China again the only region delivering growth (up 19% y/y) while Europe was down 8.5% and North America -8.4% y/y. BHKP shipments were down 3% y/y and BHKP inventories were up 2 days to 48, (inventories were up 2 days on average from September-October in the last 5 years). SW shipments were up 2% y/y and inventories up 1 day to 31. (Source: EUWID, RISI, BTG Pactual, PPPC & other industry reports)