Wingate Partners Sells Dunn Paper to Arbor Investments

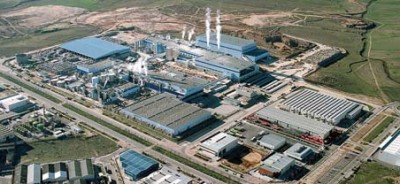

(USA, Aug. 29, 2016) Wingate Partners, a Dallas-based private equity firm, completed the sale of its portfolio company, Dunn Paper, Inc. to Arbor Investments, a Chicago-based private equity firm. Dunn is a U.S. manufacturer of specialty papers and tissues for food packaging and consumer product markets.

Terms of the deal were not disclosed

Wingate partnered with the Dunn management team to acquire the business in July 2010.

“Brent and the Dunn team have done an outstanding job of executing day in and day out to achieve a compelling vision. They are first class people and world class operators. It’s been a privilege to partner with them,” said Brad Brenneman, Chairman of Dunn and a Partner at Wingate.

Brent Earnshaw, Dunn’s CEO, commented, “Wingate has been a great partner. They have brought a wealth of experience and a low-ego, highly approachable style that has made them a pleasure to partner with. The Dunn team looks forward to continuing our growth with our new partners at Arbor.”

Brian Steinbrueck, Partner at Wingate, added, “Dunn represents the ideal type of investment for Wingate. Prior to our investment, Dunn had been a relatively fragile business in a difficult industry. However, Dunn has consistently provided a highly valuable service to its customers and the Dunn team has done a terrific job of executing on opportunities to make the business more differentiated and successful.”

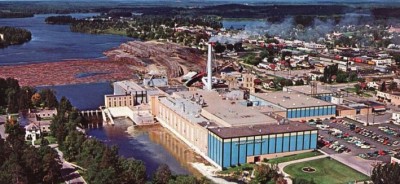

Dunn Paper is a manufacturer of a wide array of specialty waxed, coated, and uncoated MG papers used in various foodservice and flexible packaging markets. The company has six mills located throughout the eastern US and Canada. To learn more, please visit www.dunnpaper.com (Source: Wingate Partners)