Q3/2016 Global HW Market Review: 1.031MT growth in global demand for BEKP; HW vs. SW spread at a high US$148/t in Europe & US$105/t in China

(Sao Paulo, Brazil, October 31, 2016) Highlights:

• Sales volume of 1,442 million tons in the quarter

• Hardwood pulp operating rate reached 92% in August

• Growth of 1.031 million t in global demand for BEKP (8M16 vs. 8M15)(4)

• Hardwood and softwood spread of US$148/t in Europe and US$105/t in China

Even though the seasonality has marked the period, an improved sales volume performance was observed when compared to 2Q16, especially in August and September. This growth, coupled with a scenario of depreciated prices especially in Asia, and a more balanced short-term outlook than expected with regard to the entry of new capacity, made Fibria announce a US$20/t price increase for Asia effective as of October, 1st. Another development in the quarter was the R$38/t drop in the production cash cost when compared to the previous quarter, taking into account the change without the impact of the scheduled maintenance downtimes, and the overall physical completion of Horizonte 2 Project of 60% by the end of September, higher than expected.

Pulp Market:

Fibria’s sales in 3Q16 totaled 1,442 thousand tons, 11% higher than the volume sold year-over year. Despite the seasonally weaker demand over part of the quarter, due to summer vacations in the Northern Hemisphere, the first signs of recovery appeared in mid-August and consolidated in September, especially in China. Sales recovery at the end of the quarter and the hardly sustainable price levels in Asia resulted in the announcement of the US$20/t price increase to be in force as of October 1 for the region.

The maintenance of the gap between hardwood and softwood pulp prices at high levels also contributed to the good sales performance over the quarter. In Europe, the reference price gap between the two types of pulp reached US$148/t in the last week of September, according to PIX/FOEX. In China, the price gap remained close to US$100/t over the entire quarter.

NBSKvs. BHKP –Prices and Spread (US$/t)

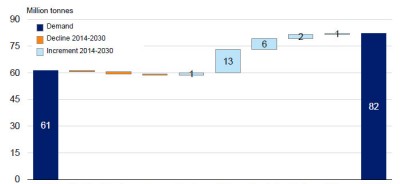

According to the PPPC’s Global-100 report data, softwood pulp sales rose by 4% in the 8 first months of 2016, driven by the demand for eucalyptus pulp, which increased by 7% in the period (+1,031 thousand t) indicating a 92% operating rate for the industry. While eucalyptus pulp sales for the European and North-American markets remained virtually stable, China’s demand grew 23% between January and August.

BHKP and BEKP Shipments – January to August 2016 vs. 2015 (change % and k tons)

(Source: PPPC Global 100)

The market fundamentals should remain balanced over the next months. On the demand side, a traditionally busier market is expected due to the favorable seasonality typical of the period. On the supply side, in addition to the likely delay in the arrival to the market of the volume resulting from the new capacities expected for 4Q16, the new calendar for scheduled maintenance downtimes in Brazil, which since last year takes into account the extension of the period between downtimes to 15 months, should result in the withdrawal of approximately 115 thousand tons from the market in the last months of 2016. (Source: Fibria / ) [Extract from Fibria Q3/16 Financial Report & 3Q/16 Conference Call] )