Pulp firm Mercer reviews Q4/16: “growth in softwood deliveries continue to be strong; looking at strong prices in February / March”

(Calgary, Canada , Feb. 10, 2017) [Extracts from Q4 2016 Financial Report & Conference Call dated Feb. 10, 2017] Mr. David M. Gandossi – Chief Executive Officer, Mercer International, discusses the Q4/16 pulp & paper market and the outlook for 2017.

Q4 Overview & Outlook:

Results:

Mercer International Inc. reported results for the fourth quarter ended December 31, 2016. The company recorded an EBITDA of $57.8 million compared to $47.9 million in Q3 2016. Our Q4 result reflects steady pulp demand, favourable foreign exchange movements, and the reversal of a wastewater fee accrual at our Stendal Mill, all partially offset by an increase in the level of scheduled annual maintenance.

Our pulp sales were down about 15,000 tons and electricity sales were down 29,000 megawatt hours relative to Q3 primarily due to Stendal’s 12 days scheduled maintenance downtime. Pulp sales realizations were essentially flat compared to Q3 with strong demand mostly offsetting the downward price pressure from the rapid appreciation of the U.S. dollar.

Q2 Market Review:

In terms of the pulp markets, demand has been very steady to the point that we’re having to say no in fact to certain spot pulp sales request we’ve been getting. We expect these balanced conditions to continue well into 2017. Demand has been strong enough to offset new capacity that entered the market in 2016.

NBSK producer inventories finished the year at 32 days and have been near this level all year. 32 days is up two days from the previous quarter but we believe inventories at this level remain balanced.

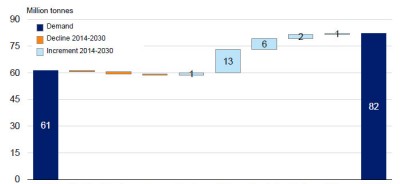

Growth in global softwood deliveries continues to be strong at over 3% year-to-date, that’s roughly 700,000 tons and China in particular was very strong at about 13% growth when compared to the same 12-month period in 2015. We believe China’s strong demand is consumer driven but it’s also the result of the closure of highly political Chinese agricultural based pulp, along with the diminishing supply of quality recycle fiber.

In addition, the Chinese paper industry continues to advance its capacity with new highly efficient paper machines to require a certain amount of premium NBSK to run efficiently. The quarterly average list price in Europe was unchanged at 8.10 per year compared to Britain compared to Q3 in 2016. Similarly, the quarterly average list price in China remained at $595 per ton compared to Q3. This is remarkable as it occurred during the period of conservable U.S. dollar appreciation.

Looking forward in China we implemented a $20 per ton increase effective January 1, is a $20 increase in early February. Mercer announced $40 in fact in February, so the March price will be 650.

In Europe we recently announced a $20 increase effective February 1. These recent price increases reflect the strong market fundamentals and our belief at the global tissue and specialty paper markets continue to grow at a steady pace.

During the company Conference Call discussion, Mr Gandossi speaking on price hikes for the Europe and China market said: “For Europe it’s up USD20/t and everybody is trying to settle accounts at USD840/t. I think it’s a steady market, it’s still under discussion but it’s a steady tight market.

In China, it’s a really strong market with lots of demand. I think that USD630/t for February is happening and USD650/t for March is looking pretty good.” (Source: Mercer Q4/16 Financial Report & Conference Call)