Pulp firm Mercer reviews Q1/17 market: “steady rise in Q1 pulp prices; strong demand”

(Calgary, Canada, April 28, 2017) “In term of the pulp markets, demand has been strong through April. Prices have risen steadily in China in Q1 to the point that our March list price was $670 per ton, up $70 from September or up $100 since November of 2016.”

[Extracts from Q1 2017 Financial Report & Conference Call dated April 28, 2017] Mr. David M. Gandossi – Chief Executive Officer, Mercer International, discusses the Q1/17 pulp & paper market and the outlook for 2017.

Q1 Overview & Outlook:

1. Results:

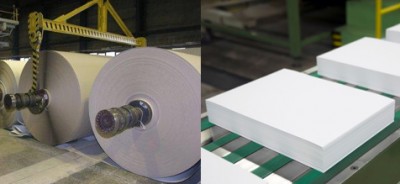

Mercer International’s Q1 financial results reflect solid operational performance, strong sales and the early impact of the NBSK pricing improvements which took hold late in the quarter. In Q1, we achieved EBITDA of $60.2 million compared to $57.8 million in Q4 2016. Our pulp sales totalled about 375,000 tons, which is up 30,000 tons compared to Q4.

2. Q1/17 Market Review:

In term of the pulp markets, demand has been strong through April. Prices have risen steadily in China in Q1 to the point that our March list price was $670 per ton, up $70 from September or up $100 since November of 2016. Demand was also strong in Europe and although prices haven’t risen as dramatically as they have in China, prices are up $30 per ton since December, and in April price announcements will take the May list price to $890 per ton.

The quarterly average list price in Europe increased to $822 per ton compared to $810 in Q4. Similarly the quarterly average list price in China increased to $645 per ton compared to $595 in Q4. ….

It’s important to note that these increases have been implemented or announced even as incremental NBSK capacity came on line in Europe in 2016 and has been ramping up. Consistent with increasing NBSK pulp prices in Q1, NBSK producer inventories were down three days to 29 days from the end of 2016. At the same time, hardwood inventories were essentially flat since December. We believe inventories at this level are well balanced.

Consistent with the upward pricing pressure on NBSK, demand through Q1 has been strong. Global NBSK shipments were up over 2% compared to the same period last year. We continue to believe China’s strong demand is consumer driven and being supported by increased tissue and paper capacity. We are also seeing the supply side impacting demand for wood pulp as highly polluting old China agricultural based pulp facilities have been closed.

To read the complete transcript Go To: “Mercer International’s (MERC) CEO David Gandossi on Q1 2017 Results – Earnings Call Transcript” (Source: Seekingalpha.com)