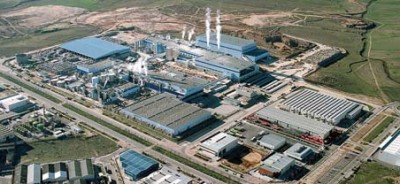

Fitch upgrades Suzano’s ratings to ‘BB+’; outlook positive

(Rio De Janeiro, June 24, 2016) Fitch Ratings has upgraded Suzano Papel e Celulose S.A.’s (Suzano) Long-Term Foreign- and Local-Currency Issuer Default Ratings (IDR) to ‘BB+’ from ‘BB’. Fitch has also upgraded Suzanos’s National Long-Term rating to ‘AA+(bra)’ from ‘AA-(bra)’. The Rating Outlook for the corporate ratings is Positive. A full list of rating actions follows at the end of this release.

The ratings upgrade reflect Suzano’s stronger free cash flow (FCF) due to the depreciation of the Brazilian real, which has reduced the company’s cost structure and allowed Suzano to accelerate deleveraging to a net debt to adjusted EBITDA ratio of 2.5x at the end of March 2016.

The Positive Rating Outlook reflects Fitch’s expectation that Suzano’s FCF will remain strong during 2016 and 2017 and net adjusted leverage will decline to below 2.0x by 2018. An upgrade could occur if the company uses its FCF to reduce gross debt by around BRL2 billion. The Positive Rating Outlook also reflects the expectation that the company’s strategy to decrease leverage and improve its capital structure will remain unchanged. (Source: press release)