Fibria reports third-quarter net revenue of R$2.3 billion, EBITDA of R$758 million and lower production cash cost

(Sao Paulo, Brazil, October 31, 2016) Highlights:

• Net income in the quarter of R$32 million, bringing net income in the first nine months to R$1.755 billion

• Sales volume in the quarter of 1,442 million tons

• Production cash cost of R$638 per ton

• Pulp production of 1,311 million tons, increasing 3%

• Construction on the Horizonte 2 Project reaches 60% completion

• The project is ahead of schedule and R$1.2 billion under budget

Fibria, a Brazilian forestry company and the world’s leading eucalyptus pulp producer, reported net revenue of R$2.3 billion in the third quarter of 2016. Net income was R$32 million in the period and brought net income in the year to date to R$1.755 billion, compared to the net loss of R$553 million in the same nine-month period of 2015.

Sales in third quarter posted a solid performance of 1,442 million tons. Reflecting the seasonally weak demand due to summer vacation in the northern hemisphere, signs of recovery began to appear in mid-August and strengthened in September. The recovery in sales towards the end of the quarter and the hardly sustainable level of prices in Asia led Fibria to announce a price increase of US$20 per ton for the region, effective October 1.

Adjusted EBITDA (earnings before interest, tax, depreciation and amortization) amounted to R$758 million in the third quarter and to R$2.937 billion in the first nine months of the year. Pro forma EBITDA margin, which excludes Klabin’s sales of pulp from the Puma Project, stood at 37% in the quarter. The Company’s third-quarter results were affected by the 3% drop in the average pulp price in USD in the period and by the depreciation in the U.S. dollar against the Brazilian real of 7% (average exchange rate in period).

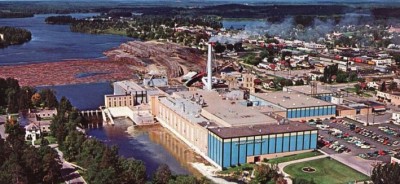

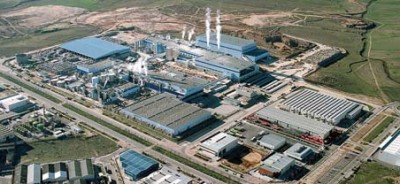

In the third quarter, pulp production amounted to 1,311 million tons, growing 2% from the volume in the second quarter of the year, due to the retrofitting of the C plant of the Aracruz Unit in Espírito Santo state in the prior quarter and the higher productivity of industrial plants, which helped to offset the effects from the scheduled maintenance shutdown at the Veracel Unit in Bahia state, the joint venture by Fibria and Stora Enso. In the first nine months of 2016, pulp production amounted to 3,802 million tons.

The third quarter was also marked by improvement in pulp production cash cost, which stood at R$638 per ton, down 4% from R$662 per ton in the second quarter. This performance was due to factors such as higher operating stability, higher production volume, the effects from the stronger Brazilian real, since approximately 15% of all costs are linked to the U.S. dollar, and the better result from energy sales, which helped offset the effects from the scheduled shutdown at the Veracel Unit. Excluding the effects from the shutdowns in the prior quarter, production cash cost was R$624 per ton, representing an even stronger decline of 6% from the second quarter, when production cash cost was R$662 per ton.

“Fibria continues to focus on operational excellence, which is a key pillar of our competitiveness. Given the more adverse environment in terms of exchange rates and pulp prices that we faced in the third quarter, controlling costs takes on even greater importance as a key factor for maintaining our industry leadership,” said Fibria CEO Marcelo Castelli.

Fibria’s cash flow, before investment in the expansion project at the Três Lagoas Unit (Horizonte 2 Project), the payment of dividends and investment in logistics, remained strong in the third quarter to reach R$402 million. In the nine-month period, free cash flow came to R$1.549 billion.

Fibria ended the third quarter with net debt of US$3.272 billion. Financial leverage, as measured by the ratio of net debt to EBITDA, stood at 2.33 times in Brazilian real and at 2.64 times in U.S. dollar, in line with the Company’s planning and within the limits set by its Indebtedness & Liquidity Policy.

“We ended the third quarter with a robust cash position of R$3.6 billion, or around US$1.1 billion, which leaves us extremely comfortable to move forward with our investment plans for the Horizonte 2 Project. The amount, coupled with other untapped financing facilities for the Horizonte 2 Project totaling US$1.2 billion, is more than sufficient to cover our financial needs for completing the project, of US$1.4 billion, and to service all debt maturing in 2016 and 2017. Furthermore, by end-2017, we will have an additional liquidity source in the form of the revenue generated by the new production line in Três Lagoas, which will strengthen our cash flow,” said Guilherme Cavalcanti, Fibria’s Chief Financial and Investor Relations Officer.

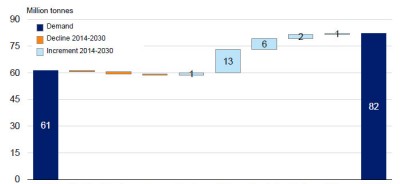

The Horizonte 2 Project, which consists of construction of a second pulp production line at the Três Lagoas Unit in the state of Mato Grosso do Sul, reached 60% completion at the end of the third quarter. The line is slated to be concluded by the start of the fourth quarter of 2017. Given the good progress on construction and the favorable conditions secured in the negotiations with suppliers, Fibria announced today that total capital expenditure on the Horizonte 2 Project, which will have annual production capacity of 1.95 million tons, decreased from the original estimate of R$8.7 billion to R$7.5 billion, representing savings of R$1.2 billion.

“The Horizonte 2 Project remains ahead of schedule and under budget, consistent with our philosophy of doing more with less. Fibria’s teams, partners and suppliers are all motivated and engaged in building the new production line, which already is a reference in the global pulp industry,” said Castelli.

In September, the company was selected for the fifth time as a component of the portfolio for 2016-2017 of the Dow Jones Sustainability World Index (DJSI World) of the New York Stock Exchange (NYSE). Fibria was the only company in the Forestry and Paper industry selected from among the nine companies participating in the selection of components for the global index. The company also was selected for the fourth straight time as a component of the Dow Jones Emerging Markets Index (DJSI Emerging Markets), which means it has been a component of the index since its creation. This year, Fibria was the only company selected from among the seven companies participating in the evaluation process.

For additional information Go To: http://www.fibria.com.br/ (Source: press release)