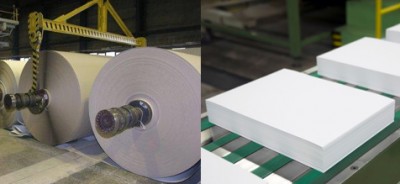

BMO’s 2017-2018 Forecast Rollout (for pulp/paper)

(Montreal, Canada, January 2017) The pulp and paper space faces some challenges in 2017. The upward bias on an already-dominant U.S. dollar will put significant pressure on pulp and paper grade pricing, and supply conditions still remain a key concern for both segments, though for different reasons.

Capacity expansion in South America and Asia will challenge the market balance for hardwood pulp, but smaller expansions in the U.S. and Sweden will likely see NBSK grade pulp slide US$10 to $928/tonne in 2017.

Newsprint and Supercalendered paper face secular declines in demand and capacity shutdowns. Prices are expected to decrease US$5 for both grades to $535/tonne and $745/tonne, respectively, as demand continues to decline faster than supply can be shut down. A stronger upward shift in the U.S. dollar induced by dramatic shifts in trade, fiscal or monetary policy would present a significant downside risk to the forecasts. (Source: The Goods / BMO Capital Markets)