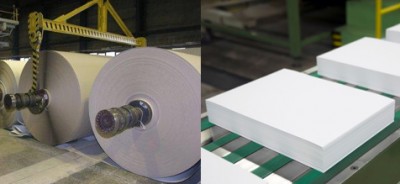

Pulp firm Mercer reviews Q2/16: “marginal increase in pulp list prices compared to Q1/16; growth in global NBSK deliveries remained steady at 3.5% year to date”

(Canada , July 30, 2016) [Extracts from Q2 2016 Financial Report & Conference Call dated July 28 – 29, 2016] Mr. David M. Gandossi – Chief Executive Officer, Mercer International, discusses the Q2/16 pulp & paper market and the outlook for the rest of 2016.

Q2 Overview & Outlook:

1. Results:

Mercer International Inc. reported results for the second quarter ended June 30, 2016. Operating EBITDA in the second quarter of 2016 declined to $34.7 million from $50.0 million in the second quarter of 2015, primarily because of lower production resulting from an extended maintenance downtime and slow mill restart.

For the second quarter of 2016, we had a net loss of $4.2 million, or $0.07 per basic and diluted share, compared to net income of $16.4 million, or $0.25 per basic and diluted share, in the second quarter of 2015.

2. Q2 Market Review:

Compared to the prior quarter of 2016, pulp list prices in the current quarter increased marginally in Europe, China and North America. As a result, our pulp price realizations increased by about 2% in the current quarter from the prior quarter of 2016. At the end of the current quarter, list prices in Europe, China and North America were approximately $810, $630 and $1,000 per ADMT, respectively.

Compared to the second quarter of 2015, average list prices for NBSK pulp in Europe and China declined by about 7% and 8%, respectively, in the current quarter of 2016, largely as a result of the strong dollar and weakening hardwood prices impacting NBSK pulp prices. This resulted in our pulp sales realizations decreasing by approximately 10% in the current quarter of 2016 from the same quarter last year.

During the company Conference Call discussion, Mr Gandossi said: “June NBSK producer inventories were 28, down two days from the previous quarter end, which reflects in our view a pretty solid market — balance in the market as we continue to see steady NBSK demand in all markets.

The July NBSK list price in Europe is consistent with June and the net price in China will likely settle a little bit lower.

Growth in global NBSK deliveries continues to be steady at 3.5% year to date and China in particular remains solid at 6.7% growth when compared to the same six month period of 2015. Currently we expect steady demand in both the European and Chinese markets but with some temporary weakness in spot pricing in China during this typically slow summer period.”

3. Outlook:

Mr. Gandossi concluded: “Currently, the NBSK pulp market is balanced with world producer inventories at about 28 days’ supply. Looking forward to the third quarter of 2016, we currently expect steady demand in Europe and China, but with the possibility of some temporary weakness in spot pricing in China during the typically slow summer period. …

Looking forward we continue to believe that the global tissue markets growth will remain steady into the foreseeable future. We expect new issue machines to continue to start up especially in China which will further strengthen demand for NBSK. We also expect the supply demand fundamentals to limit the impact of slower buying trends that often occur in Q3.

Regarding the much discussed incremental NBSK supply coming on later this year and in 2017, we believe that the timing of these mill starts is such that the additional capacity will not negatively impact the market until late 2017. Our view on this is that overall NBSK prices are near floor levels for some producers on the higher end of the cost curve. Should prices slide we believe that high cost producers will be under significant financial pressure.” (Source: Mercer Q2/16 Financial Report & Conference Call)