Catalyst Paper Corporation’s Principal Securityholders and KGI Enter Into a Support Agreement for a Potential Acquisition of Catalyst Paper

(USA, June 30, 2016) Catalyst Paper Corporation today announced that it has been advised that the four largest shareholders of the Company holding or controlling approximately 79% of the Company’s outstanding common shares, that include Mudrick Capital Management, L.P., Cyrus Capital Partners, LP, Oaktree Capital Management, LP and Stonehill Capital Management LLC have entered into a support agreement with Kejriwal Group International (KGI). The Principal Securityholders have filed Schedule 13D with the United States Securities and Exchange Commission setting out the details of the support agreement.

The support agreement has been entered into between KGI and the Principal Securityholders following previously disclosed discussions. The Company is not a party to the support agreement, nor has it been a party to the discussions that led to it.

The Principal Securityholders have committed to support and vote in favour of a transaction to be implemented by way of a plan of arrangement under the Canada Business Corporations Act, the terms of which would include:

–common shares held by minority shareholders would be acquired for C$6.00 per share, subject to a maximum aggregate payment of C$18 million;

–common shares held by the Principal Securityholders would be exchanged for interests in a new junior convertible term loan;

–existing PIK toggle senior secured notes due 2017 would be exchanged for interests in a new 5-year US$260.5 million term loan;

–existing credit facilities, including the Company’s ABL Facility, would have their maturities extended, or be refinanced; and

–trade and other obligations remaining unaffected.

The support agreement among KGI and the Principal Securityholders includes material conditions and other provisions including satisfactory due diligence by KGI to occur over a period of up to 75 days, the refinancing or maturity extensions of the existing credit facilities of Catalyst, securityholder, regulatory and court approvals, and funding at closing. The support agreement contemplates an outside date to complete the transaction of November 30, 2016, subject to extension.

The Board of Directors has not yet entered into any discussions regarding the potential transaction with KGI or agreed to the contemplated process and timeline set forth in the support agreement. The Board of Directors is encouraged by KGI’s proposal and will be pleased to review and evaluate the proposed transaction and the process contemplated by the support agreement with the assistance of legal and financial advisors.

There can be no assurance that any agreement to implement the transaction will be entered into between KGI and Catalyst, and on what terms, that any of the material conditions to the transaction will be satisfied, or that this or any other transaction will be approved or consummated.

The Company does not undertake any obligation to provide any updates with respect to this or any other transaction, except as required under applicable law. Interested stakeholders may access the Principal Stakeholders’ filings, including the support agreement, from time to time with the U.S. Securities and Exchange Commission by visiting EDGAR on the SEC website at www.sec.gov/edgar.shtml

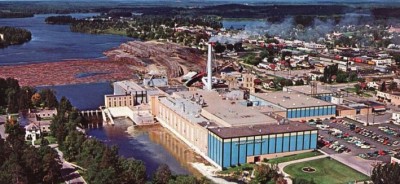

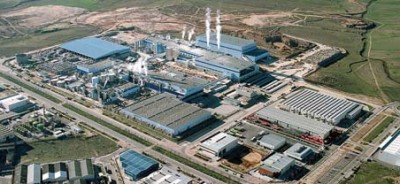

Catalyst Paper manufactures diverse printing papers such as coated freesheet, C1S, coated and uncoated groundwood, newsprint, directory, as well as market pulp. With five mills across North America, Catalyst has annual production capacity of 2.3 million tonnes. To learn more, please visit: www.catalystpaper.com. (Source: Catalyst Paper Corp. press release)