10 top trends of 2016: The Internet World of Packaging

(Brussels, January 2016) The world is one big shopping centre. POS is everywhere. We are in the middle of a revolution. The Internet is simply changing everything: design, marketing and trade structures. This also has far-reaching consequences for packaging, which is playing an even greater role as it moves towards becoming the central element of the buying experience. Pro Carton has looked at the 10 most important international trends.

Three current developments are driving these trends:

First: it still takes customers much too long to key in data. New address services are turning this into a thing of the past. An addressee’s name will soon suffice for a gift to be on its way. Alibaba has already gone one step further: in March 2015 CEO Jack Ma demonstrated technology that will allow users to pay ‘selfie style’ using smartphone face recognition.

Secondly: things announced long ago are now becoming reality – domestic appliances are becoming an interface for retail. Amazon Dash Replenishment Service already allows reordering of detergents via a washing machine sensor. Corresponding partnerships with manufacturers are ongoing. Gartner, a US consulting firm, estimates that machines linked to the Internet will generate sales of USD 263 billion in 2020.

Third: delivery will speed up considerably. In the UK Argos offers same day delivery 7 days a week for small orders to 90% of households. Amazon UK delivers food and drink items to selected locations in under an hour for GBP 6.99, or free to Prime users, with a minimum basket spend. Ocado offers same day delivery and hourly slots, covering 70% of households.

Overall, information is becoming more and more transparent and services are getting faster and faster. This has a bearing on the entire Supply Chain.

1. Design: the end of authenticity

Demonstrative authenticity is a thing of the past. Words such as artisanal “have lost all sense of meaning, value, truth and descriptive weight,” says Martin Raymond, editor-in-chief at The Future Laboratory, a London lifestyle and consumer insight consultancy. What counts is real authenticity, one that does not need explaining. More important than an “authentic” appearance is convincing performance combining technical quality and natural origin. The anti-authenticity backlash “does not mean that products cannot be authentic, artisanal or crafted,” says Raymond, but “like true luxury, such benefits need to be apparent, manifest and implicit.”

2. Design: clear communications

With the growing number of on-pack claims competing for shoppers’ attention, consumers are demanding more information about what they are buying but seeking less on-pack clutter that confuses their purchasing decisions. This is perhaps nowhere more apparent than in food, where 58% of UK consumers check ingredient information on product packaging and 76% are concerned about the use of artificial preservatives. Clear and concise information about ingredients, functional product attributes, or even convenience and safety must be communicated with total transparency – a key responsibility brands and consumers are placing squarely on packaging.

3. Marketing: naturalness becomes the measure of all things

Natural is back – as anxious consumers reject an industrial system that appears increasingly toxic and damaging to health, they are turning toward natural products as a solution. Raised on digital culture, they no longer see nature and technology as mutually exclusive, and are combining the best aspects of both to build New Natural lifestyles. Diet, beauty, wellbeing, mind, body, fitness: all are viewed by the consumer as one big ecosystem to maintain. Brands, once judged on their desirability and products, are now being judged on their value systems, on whether they are innovators, on whether they are promising to change the world.

4. Marketing: being honest counts

Having a social mission is no longer a bonus but a core expectation among consumers, particularly millennials. A recent survey of consumer attitudes to brands found that 88 % of UK and US millennials and generation Xers believe brands need to do more good, not just “less bad.” Now companies are taking social good to epic proportions. Lego, aware of the ever-growing number of plastic toys in landfill, has invested USD 150 million into research on sustainable materials. Ikea is dwarfing most governments with its investment in sustainability. The Swedish home retailer has vowed to spend EUR 1 billion on renewable energy. As tech luminary Biz Stone said during South by Southwest Interactive 2015, “The future of marketing is philanthropy.”

5. Marketing: sustainable products are preferred

Sustainability is a fundamental future trend. The greater the worries about our planet grow, the fewer the chances for Plastic & Co. It is true that many consumers do not have the extra budget to spend more on sustainability. However, 63% of US consumers have stated that reusable and repurposable packaging is a key purchasing driver they see as being yet another link in the long and complex green packaging chain. When product price and perceived product quality are equal, consumers will be increasingly turning to these eco- and alternative-use attributes as the deciding purchasing factor. Going forward, brands cannot afford to ignore this.

6. Marketing: the brain reveals its secrets

Neuromarketing – a buzzword for years now in the agency world – is finally moving into the realm of serious science and real applications. A study published in the September 2015 edition of the Social Cognitive and Affective Neuroscience journal found that researchers were able to predict accurately the large-scale outcomes of an anti-smoking campaign by measuring brain responses using an fMRI machine (fMRT, functional magnetic resonance tomography). Compared to traditional methods, the brain data more than doubled the researchers’ ability to predict responses to the anti-smoking campaign—a hugely significant and largely unprecedented result for such a study.

7. Trade: the three pillars of growth

Growth in the retail trade is based on three pillars: Internet, Discount and Convenience. Larger volumes and store-cupboard items are mainly purchased via the Internet and in discount stores. IGD is forecasting online to be the fastest-growing segment of the UK grocery market over the next five years, almost doubling in value from GBP 8.9bn in April 2015 to GBP 17.2bn by April 2020. Smaller daily staples will still be purchased in the corner shop. James Walton of IGD: “New openings may be smaller than the usual 3,000 sq ft max with micro-convenience stores of around 1,000 sq ft. Such stores are already commonplace elsewhere in the world (Hong Kong, Japan), but successful operation requires advanced logistics, clever ranging and space management skills.” Micro-convenience stores also provide a platform for another key trend – retail ‘hybridisation’. This uses physical stores to bridge real-world and digital operations, for example by offering pick-up points for online orders.

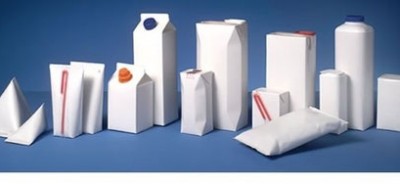

8. Packaging: advertising space for ready distribution

What the retail trade needs is ready-for-distribution packaging in different sizes to perform tasks perfectly over all channels and to advertise the products at the POS – wherever that may be. Meanwhile, 39% of UK consumers would like to see a wider range of smaller bottles of alcoholic beverages. As evident by the 50% of health-conscious snackers saying they’d be willing to try a new product if it comes in a small, trial-size pack, as brands’ product portfolios grow, the ability to reach consumers in unique and time-shifting uses means brand-owners must offer a greater range of pack sizes – both larger and smaller. In 2016, following such major downsizing strategies as those by Kellogg’s in 2015, if brand-owners are to overcome the growing lack of consumer brand loyalty, they must create and deliver packaging that consumers see as right-sized for themselves, their families, and shifting uses.

9. Packaging: the direct link

There’s a revolution happening in mobile-engaged packaging. Mobile interactions will account for 64 cents of every US dollar spent in retail stores by the end of 2016. But unlike the previous generation of mobile-enabled packaging – which included clunky QR and text codes, as well as often-disappointing augmented reality experiences – this time around, brand owners are tapping near-field communication (NFC) and bluetooth low-energy (BLE) as primary engagement technologies to deliver on the promise that so many first generation mobile engagements either didn’t or couldn’t. Moving forward, as brands clamour for innovative ways to engage and connect with shoppers, the mobile environment will become the new front line in the battle to win consumers’ hearts, minds, and wallets.

10. Packaging: a digital print revolution

The unique capabilities of digital printing have captured the attention of retailers, brand owners, and packaging converters around the world. Brought into the global mainstream limelight by the tremendous success of Coca-Cola’s “Share a Coke” campaign, digital printing is capturing brands’ attention by creating opportunities to engage consumers on a local, personal, or even emotional level. One in five US millennials is seeking custom or personalized packaging, and nearly one quarter of Chinese consumers indicate they would pay more for personalized soft drink packaging. Thus digital printing is positioned to grow well beyond the 10% share of the packaging market it is currently estimated to account for. Mintel believes 2016 will be the turning point for digital package printing, as brands and package converters begin to move beyond using digital primarily for limited editions and personalization, and begin to capitalize on its economic and speed-to-market advantages for mainstream package decoration.

“As you can see, packaging is facing a number of exciting prospects in the sense that we need to be absolutely ready for the future wishes and needs of consumers and the retail trade”, says Roland Rex, President of Pro Carton. “The entire cartonboard and carton industry is well equipped to meet these challenges and we look forward to the tasks ahead as packaging takes on even greater responsibility in the sustainability arena. We see an amazing dynamic development for packaging in general and look forward to the future novelties and advances in cooperation with the entire Supply Chain.” (Source: Pro Carton press release [Pro Carton is the European Association of Carton and Cartonboard manufacturers])