Five key trends driving evolution of world fluff pulp market; global fluff pulp market set to remain buoyant, even as it undergoes progressive changes, as per Smithers Pira report

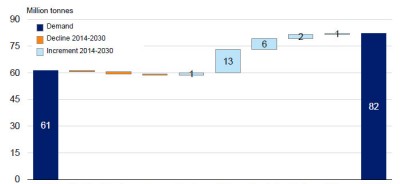

(London, UK, February 02, 2016) In its new report “The Future of Global Fluff Pulp to 2020”, Smithers charts how the 6.0 million air dried tonnes of fluff pulp that was produced in 2015, is projected to increase to 7.3 million air dried tonnes in 2020.

Total global sales of fluff pulp in 2015 were $4.5 billion (€4.2 billion); up from $3.9 billion in 2010. This is projected to grow to $5.0 billion in 2020. This healthy expansion is taking place, despite a continuing reduction in volume of fluff pulp employed in individual products in its major end uses. This market resilience can be attributed to a growth in use of adult incontinence products, and increases in infant diaper (nappy) sales in emerging markets.

In a new report The Future of Fluff Pulp to 2020, Smithers Pira identifies the key trends that are driving this industry.

1. Nonwovens are the fastest growing end use:

The fastest growing major end-use for fluff pulp is in nonwovens. The consumption of fluff pulp for large hygiene end-uses is projected to increase 3.4% by weight annually through 2020, the nonwovens segment is projected to increase its fluff pulp consumption by 5.4% year-on-year. In 2015, Nonwovens represent 8.5% of the global fluff pulp demand, with airlaid nonwovens being the most significant sub-market for fluff pulp.

2. Hygiene markets will maintain a dominant market share:

Historically, the hygiene end-uses — baby diapers/nappies, feminine hygiene pads, and adult incontinence products — have accounted for the majority of the fluff pulp consumed globally and have driven expansion of the world market. In 2010, these hygiene end-uses accounted for 91.6% of the fluff pulp consumed globally. By 2020, these end-uses will consume slightly less — 90.3% — a small drop in market share that is indicative of longer-term trends.

3. The most mature markets will grow slowest:

Diapers are key products in the global fluff pulp market; they use more fluff pulp per unit than the more numerous feminine hygiene pads, and sell more units than larger adult-size incontinence products. Year-on-year growth rates for infant diapers are expected to be around 2.2% in volume terms over the next 5 years.

The major feminine hygiene products using fluff pulp are pads. Over the next 5 years the annual growth rate for fluff pulp market in all feminine hygiene end-use applications is estimated to be 3.2% in volume terms. The closer a region is to modern first world consumption patterns, the higher the use of feminine hygiene pantiliners is; including their use on non-menstrual flow days. Hence over the next five years hygiene pads sales will increase most rapidly in those regions and countries that are embracing a globalised consumer culture.

4. The least mature market will expand most rapidly:

The adult incontinence market sits between feminine hygiene and baby diapers in product design, potential, penetration, and current status. Incontinence products for light flow are really just rebranded feminine hygiene pads; while adult incontinence briefs are scaled up versions of infant diapers.

Smithers forecasts that the global annual growth rate in this relatively new segment over the next 5 years will be 4.5%, well above the market average.

The key factors affecting the adult incontinence products market are increases in:

–The number of adults aged 65 years old and above

–The number of females 40 – 65 years old

–The market penetration of products

–The erosion of culturally driven reticence over use

–Disposable incomes

5. North America dominates the competitive landscape:

The competitive landscape for fluff pulp is dominated by large pulp and paper companies located in North America. This is mainly due to the presence of the most optimal wood species for fluff pulp being native to the continent. The short growing seasons in north Europe and north Asia, and the lack of optimal soil and climate conditions in most of south Asia has reduced the impact of these regions. Infrastructure issues in South America and Russia have slowed progress in these regions.

The four largest fluff pulp producers are Georgia-Pacific, Weyerhaeuser, International Paper, and Domtar. Together they accounted for about 80% of all fluff pulp production in 2015. The ten largest producers represent about 99% of global fluff pulp production – of these top ten producers, six are in North America, three are in Western Europe and one is in South America.

This market place will be disrupted over the next five years. Chinese paper company, Sun Paper, has signed a memorandum of understanding to study the possibility of building a 700,000 air dried tonne fluff pulp plant in the US state of Arkansas. This plant is set to add about 10% to global fluff capacity when it is completed in 2018; this will elevate Sun Paper to the fifth largest global producer of fluff pulp. (Source: Smithers Pira)