1Q/16 Global HW Pulp Market Review: prices remain under pressure; Asian prices bottomed out at the end of 1Q16

(Sao Paulo, Brazil, April 20, 2016) Seasonality and the more challenging scenario throughout 1Q16 continued to pressure pulp prices in dollars, especially in Asia. However, according to the PPPC, global eucalyptus pulp sales moved up by 7% in the first two months of the year over the same period in 2015. Fibria’s sales to Asia moved up at the end of the quarter, exceeding the volume routed to the region in the previous three months. In addition, reflecting the increased complexity of the sector and overall economic scenarios, hardwood pulp producers anticipated their maintenance downtimes, mitigating the factors that had been fueling the recent price slide.

The Pulp Market

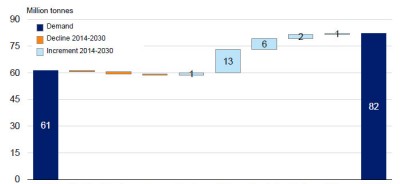

The first quarter was marked by a challenging market scenario. In addition to the traditional period downturn in demand, the pressure on prices, which began at the end of 2015 and came chiefly from Chinese customers, continued throughout the opening months of the year. Indeed, China’s demand for hardwood pulp remained under pressure in January and February, as shown by PPPC data in the chart below.

However, the feeling that Asian prices had bottomed out at the end of 1Q16 meant that there was a significant recovery in sales volumes to Chinese customers in March. This was supported by the anticipated downtimes of several hardwood pulp producers in China and Indonesia and healthy demand for softwood pulp since the beginning of the year led prices to stabilize, which, combined with the downturn in hardwood pulp prices, led to a significant increase in the price gap between the two types of pulp, both in Asia and Europe. During the quarter, this gap reached US$70/t in Asia, while in Europe it widened from US$14/t at the end of 2015 to US$53/t in 1Q16, according to the PIX/FOEX.

According to the PPPC’s Global 100 Report, global hardwood pulp sales moved up by 2.7% in the first two months of the year over the same period in 2015, due to the 6.8% period upturn in eucalyptus pulp sales, given that the other types of hardwood pulp posted declines. Unlike the results from previous quarters, sales to North America and Europe exceeded the upturn in sales to China, thanks to the excellent paper market conditions in these regions at the moment.

Despite expectations of new capacity start-ups, the recovery in sales volume and the reduction in pulp available to the market due to the hardwood pulp maintenance downtimes announced for the second quarter (around 280 thousand tons) should ensure a more favorable market situation in the coming months. (Source: Fibria 1Q/16 Financial Report)